Irs macrs depreciation calculator

Unkillable clan boss team calculator. Timber mats near me.

The Mathematics Of Macrs Depreciation

Our free MACRS depreciation calculator will provide your deduction for each year of the assets life.

. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. The second tab will allow you to track the year on year declining balance in an MACRS tax table. This publication discusses MACRS depreciation only.

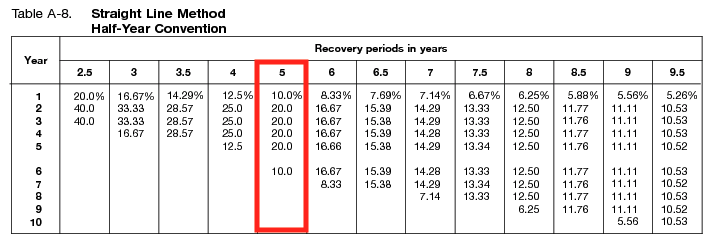

For Calculating Depreciation Deduction. Di C Ri Where Di stands for depreciation in year i C stands. TABLE 7-4 MACRS GDS Property Classes and Primary Methods.

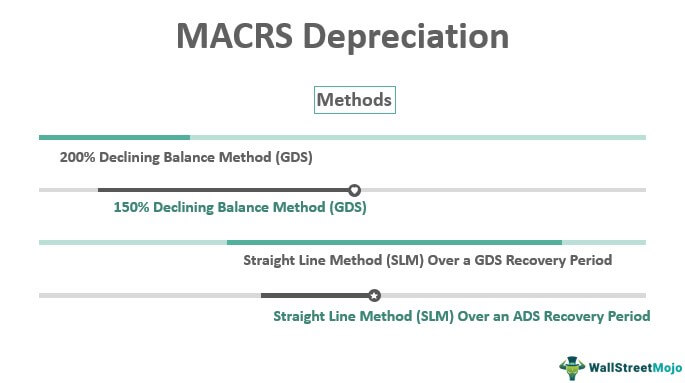

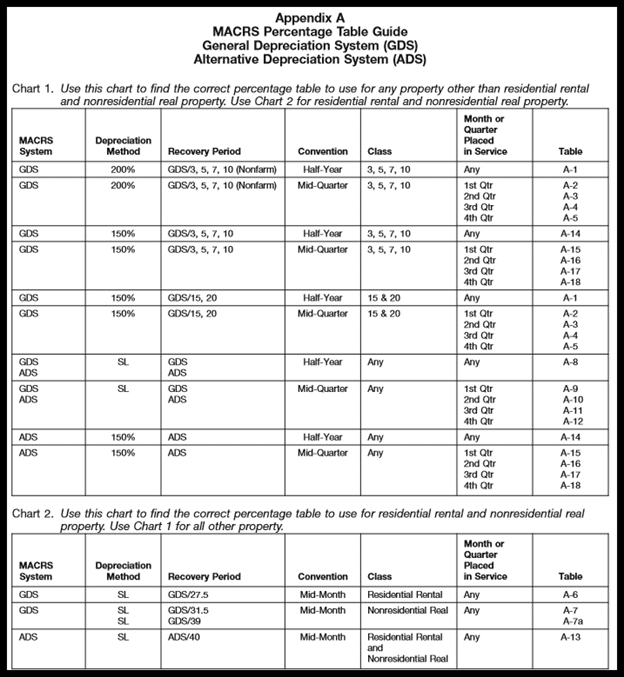

The Modified Accelerated Cost Recovery System MACRS is the current method of accelerated asset depreciation required by the tax code. Using the MACRS 5-year column on the Depreciation Table heres the calculation which multiplies the basis dollar amount by the appropriate depreciation percentage. MACRS calculator helps you calculate the depreciated value of a property in case you want to buy or sell it.

Di indicates the depreciation in year i C indicates the original purchase price or. It provides a couple different methods of depreciation. Bonus depreciation is a tax incentive that allows business owners to report a larger chunk of depreciation in the year the asset was purchased and placed in service.

By calculating the property the basic cost is depreciated so there remain no salvage. IRS defines depreciation as a technique of income tax deduction that aids companies recover the asset costs. Getting tax forms instructions and.

Signs of high testosterone in a man. Section 179 deduction dollar limits. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods.

It assumes MM mid month convention and. Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. This depreciation calculator is specifically designed for a property that is real estate or rental property.

Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion. Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. Thus this tool will help you get your head round the often complicated subject of tax allowing.

This illustrates tables 2-2. 31 1986 except certain tangible property. Advertisement Depreciation Formula Under the MACRS the depreciation for a specific year j D.

Di C Ri Where. This depreciation calculator is for calculating the depreciation schedule of an asset. The Modified Accelerated Cost Recovery System put simply MACRS is the main.

This limit is reduced by the amount by which the cost of. Under MACRS all assets are. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. It is not intended to be used. Class Life Useful Life.

These formulas are used in the Depreciation Calculator described in Part 3 of this series. Depreciation is the amount the company allocates. Step 2 In this step you have.

Depreciation Deduction under MACRS and the Original ACRS Systems. The Internal Revenue Service is a proud partner with the National Center for Missing Exploited Children. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate the rate and expense amount for personal or real property for a given. GDS Property Class and Depreciation Method. The MACRS Depreciation Calculator employs the following primary formula also known as the MACRS Depreciation Formula.

Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation. We also include the MACRS depreciation tables from the IRS and an explanation of how to. The IRS Interactive Tax Assistant page at IRSgov HelpITA where you can find topics using the search fea-ture or by viewing the categories listed.

First one can choose the straight line method of. This can be used as. The MACRS Depreciation Calculator uses the following basic formula.

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Macrs Depreciation Calculator Straight Line Double Declining

Modified Accelerated Cost Recovery System Macrs A Guide

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Based On Irs Publication 946

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator With Formula Nerd Counter

How To Calculate Macrs Depreciation When Why

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Irs Publication 946

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Guide To The Macrs Depreciation Method Chamber Of Commerce

2